Navigating the Commodities Market During Periods of High Volatility

Introduction

Ever felt the thrill of a roller coaster ride? The commodities market in volatile times can feel just like that - exhilarating highs, nerve-wracking lows, and the adrenaline rush of the unknown. But fear not! With the right knowledge and strategies and the power of commodity price forecasting, you can turn this ride into a profitable journey.

The commodities market, often seen as the world's economic barometer, is a vast expanse where raw or primary products change hands. From the coffee you sip in the morning to the gold adorning your wrist, commodities touch every facet of our lives. But what happens when global events shake this market? Understanding its volatility becomes our compass, guiding us through the storm.

The Essence of Commodity Markets

Before we delve deeper into the tumultuous waves of market volatility, let's anchor ourselves with a fundamental understanding of what commodity markets are.

Commodity Markets Unveiled

At its core, a commodity market is a virtual or physical marketplace where buyers and sellers converge to trade raw or primary products. Think of it as a grand bazaar, bustling with activity, where goods ranging from tangible items like grains, metals, and oil to intangible assets like bonds and currencies are exchanged.

Why Are Commodity Markets Important?

Commodity markets play a pivotal role in the global economic machinery. They:

Determine Prices: Through the dance of supply and demand, these markets set the prices for essential goods, impacting everything from your morning coffee's cost to the fuel for your car.

Facilitate Global Trade: They enable producers to sell their goods to distant consumers, fostering global trade.

Offer Investment Opportunities: For traders and investors, commodity markets present a chance to diversify portfolios and hedge against risks.

Decoding Market Volatility

Market volatility, often visualized as the unpredictable waves of the ocean, can be both a trader's dream and a nightmare. While it offers opportunities for high returns, it also comes with increased risks. To navigate these choppy waters, one must first understand the forces that stir them.

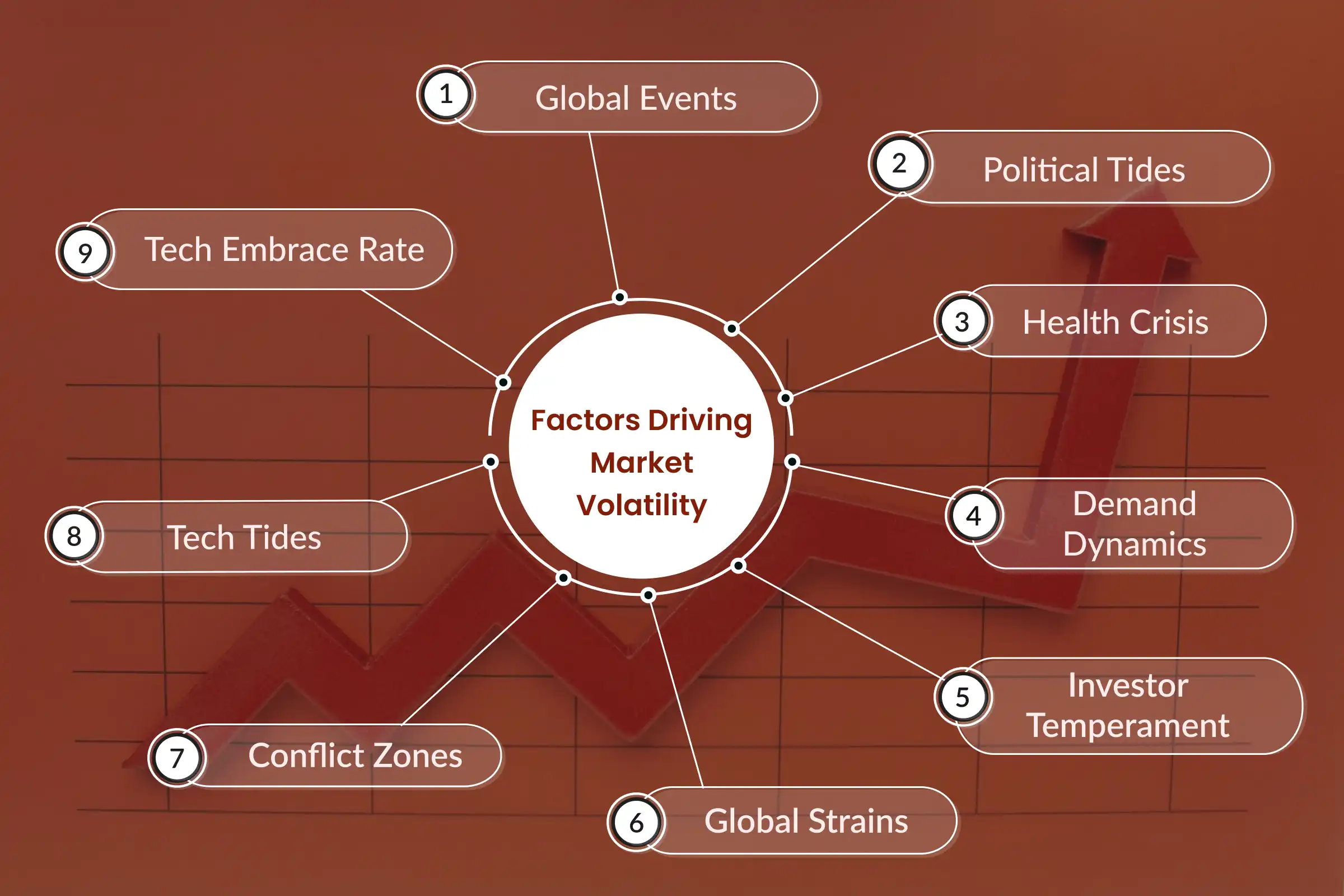

Factors Driving Market Volatility

Global Events:

Natural Disasters: Events like earthquakes or hurricanes can jolt production zones, leading to supply hiccups. For instance, an oil rig hit by a cyclone can cause oil prices to surge.

Political Tides:

Elections or policy shifts can create market ripples. A new government might introduce trade policies, swaying commodity prices.

Economic Indicators: Metrics like job rates, inflation figures, and GDP growth can steer investor behavior, influencing market volatility.

Health Crisis:

Supply Chain Hurdles: Pandemics can freeze production and logistics, causing supply gaps and price ascents.

Demand Dynamics:

A health crisis can diminish demand for some commodities. For example, oil demand dipped during COVID-19 due to decreased travel.

Investor Temperament:

The uncertainties of a pandemic can make investors cautious, triggering rapid market exits.

Global Strains:

Trade Tussles: Tariff impositions and trade curbs can elevate commodity prices. The trade tensions between the U.S. and China, for instance, swayed several commodity prices.

Conflict Zones:

Armed conflicts can halt production, especially in resource-abundant areas. Moreover, sanctions on countries can tweak global commodity prices.

Diplomatic Dynamics: Even without overt conflict, frosty relations between nations can inject uncertainties into the market.

Tech Tides:

Innovative Waves: Technological leaps can reduce reliance on certain commodities. The surge in renewables, for instance, challenges traditional energy sources.

Tech Embrace Rate:

The velocity of new tech adoption can influence market volatility. Swift adoption can lead to rapid dwindling in demand for older commodities.

Measuring Market Volatility

The Volatility Index (often called the "fear index") is a popular tool to gauge the market's anxiety level. A high value indicates that traders expect significant price swings, while a low value suggests a calmer market.

Strategies to Sail Through Volatile Waters

In the face of a storm, a seasoned sailor adjusts the sails. Similarly, traders need to adapt their strategies during volatile times:

Commodity Price Forecasting:

Much like a sailor's compass, commodity price forecasting provides direction in the uncertain seas of the commodities market. By predicting future price movements based on historical data, market trends, and analytical tools, traders can make informed decisions. This proactive approach allows them to anticipate market shifts, hedge against potential risks, and seize lucrative opportunities.

Stop Loss: Think of this as your anchor. By setting a predetermined selling price, you prevent your ship (investment) from drifting too far into turbulent waters. In volatile times, a broader stop loss can prevent unnecessary sell-offs due to short-term price fluctuations.

Trading Options: This is akin to having multiple sails for different winds. The Straddle strategy, for instance, allows traders to benefit from price movements in any direction, offering a safety net of sorts.

Breakouts: Imagine spotting a lighthouse in the distance, signaling a safe path. Breakouts in stock prices can be similar indicators, pointing towards potential uptrends. In volatile conditions, these breakouts can lead to swift price gains.

Trending Stocks: Just as sailors rely on stars for navigation, traders can look at stocks that align with the market's direction. Such stocks often amplify their trend in volatile scenarios, promising higher returns.

Taking Profits: In unpredictable waters, it's wise to dock at safe harbors periodically. By liquidating profits at intervals, traders ensure they have the necessary resources for unforeseen challenges.

Mastering Commodity Price Risk Management

The past few years have seen commodities markets sway under the weight of events like the COVID-19 pandemic. To steer clear of potential pitfalls, understanding supply and demand fundamentals is crucial. Tools like PriceVision or Carryout/Usage ratios provide invaluable insights into these dynamics, helping traders navigate potential pitfalls.

Yet, one of the most potent tools in a trader's arsenal is PriceVision’s Commodity Price Forecasting. By predicting future price trajectories based on historical data and market trends, traders can anticipate market movements. This foresight not only allows them to hedge against potential risks but also positions them to capitalize on lucrative opportunities, ensuring a balanced and proactive approach to the unpredictable nature of commodity markets.

Global Currents Shaping Volatility

The world economy is an intricate web. A tremor in one part can send shockwaves throughout. Major economies, with their vast trading networks, can influence global market volatility. A downturn in a leading economy, for instance, can depress commodity prices, impacting nations dependent on commodity exports.

Conclusion

The commodities market, with its vast expanse and inherent volatility, can seem like a daunting frontier. Yet, with tools like PriceVision’s commodity price forecasting, traders are equipped to anticipate the tides and navigate with confidence. As we chart our course in this dynamic realm, staying informed, adaptable, and proactive remains our beacon to success.

FAQs

Why is the commodities market experiencing high volatility?

Factors like global events, supply-demand imbalances, and geopolitical tensions can induce volatility.

How can traders safeguard against market volatility?

Diversify portfolios, stay informed, and consider hedging strategies.

Are all commodities equally volatile?

No, some commodities, like precious metals, can be more stable, while others, like oil, might fluctuate more.

Is high volatility in the commodities market always bad?

Not necessarily. While it presents risks, it also offers trading opportunities for informed investors.