Exploring the Dynamics of the Steel Market in India

Steel is a necessary good. Its strength and versatility make it useful in a wide range of industries. These industries affect our daily lives, including construction and automotive manufacturing. Steel prices are a reflection of a country's economic health. Studying them is vital to understanding economic trends in general. India is the world's second-largest steel manufacturer. It offers interesting views on national laws, global trends, and technical advancements. This research provides clarity on the competition in the Indian steel sector. It also identifies its global implications. It can be helpful for investors, policymakers, and industry insiders alike.

Overview of the Steel Market in India

In 1907 the Tata Iron and Steel Company (TISCO) was set up. It started a period of significant transformation in the sector. The 1950s Five-Year Plans emphasized the industry's need for economic expansion after independence.

To guarantee self-sufficiency, integrated steel plants were set up in many regions. It included Bhilai, Durgapur, and Rourkela. Besides economic reforms, the 1990s saw the advent of a revolutionary period. More productive industrial techniques and foreign and private investment brought new prosperity. India became a prominent player in the global steel market during this period.

The Current Scenario of the Indian Steel Market

Steel production is a measure of a nation's economic strength. India's steel sector, comprising major, secondary, and basic producers, is essential. In FY23, India became the second-largest producer of crude steel globally.

Its total steel output was 121.29 MT, with 125.32 MT being crude. In FY24, we are expecting more expansion, with a 4-7% increase to 123–127 MT. This expansion is being driven by cheap and abundant labor and raw commodities. Industry modernization initiatives ensure modern facilities and increased energy efficiency.

The Ministry of Steel anticipates an 8% annual growth in steel demand for both 2024 and 2025, driven by sustained investments in infrastructure and expansion across all steel-using sectors.

In the first quarter of FY25, India's steel sector achieved significant milestones:

- Crude Steel Production: 36.61 MT

- Finished Steel Production: 35.77 MT

[Source:]

Factors Behind the Growth of Steel Production in India

To understand why steel production in India increased between fiscal years 2021-22 and 2022-23, with further expansion projected for FY25. let's look at key factors behind this growth:

1. Government Support and Policies

The Indian government actively backs the steel industry, as seen in initiatives like the National Steel Policy 2017. This policy aims to boost industry growth until 2030-31. Additionally, guidelines for the approved specialty steel production-linked incentive (PLI) scheme have encouraged investment and sectoral expansion.

2. Domestic Demand

A steady rise in domestic demand has fueled growth in the Indian steel sector. Over the past decade, production has risen by 75%, while domestic demand has soared by about 80% since 2008. This organic growth has led to increased steel-making capacity to meet rising demands.

India’s steel demand is growing by an estimated 8% annually in 2025, according to the Ministry of Steel. Key drivers include:

- Rapid urbanization.

- Expansion of the construction and manufacturing sectors.

- Increased investments in infrastructure projects. The domestic consumption of finished steel reached 35.42 MT in Q1 FY25, a significant increase from the same period in FY23

3. Infrastructure Development

Steel demand gets a significant boost from infrastructure development projects such as roads, buildings, bridges, and pipelines. As India aims to become a 5 trillion-dollar economy, steel industry growth becomes pivotal, serving as a vital indicator of economic advancement.

4. Raw Material Availability

India's abundant reserves of high-grade iron ore and non-coking coal give it a competitive edge in steel production. States like Odisha, Chhattisgarh, Jharkhand, and Karnataka boast significant iron ore deposits, supporting industry growth.

5. Global Market Position

India's strategic location and long coastline have made it a significant player in the global steel market, facilitating both exports and imports. As the world's second-largest producer of crude steel, India's role in global steel consumption has strengthened over time.

6. Demand-Supply Dynamics

Although India's per capita steel consumption remains relatively low compared to the global average, there's ample room for growth. Government initiatives like affordable housing programs, railway network expansion, and growth in sectors like automobiles and defense are expected to drive increased steel demand in the future.

The rise in steel production in India between fiscal years 2021-22 and 2022-23 is the result of several factors, including government support, robust domestic demand, infrastructure development, employment opportunities, raw material availability, global market positioning, and favorable demand-supply dynamics. These factors collectively contribute to the growth of the Indian steel industry, making it a key player in the global market and a significant driver of the country's economic progress.

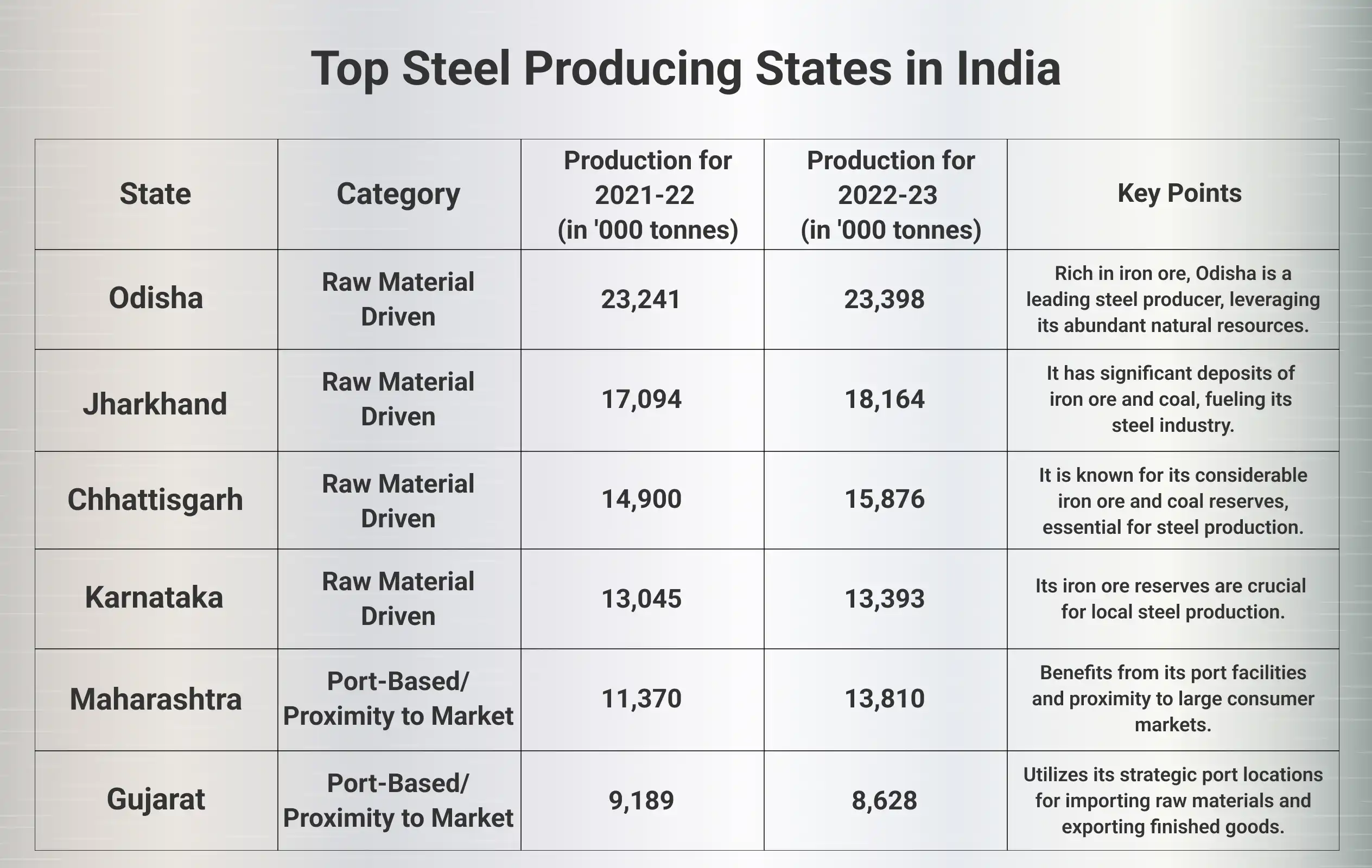

Top Steel Producing States in India

Source

Total Production for FY 2021-22- 120293 (000 tonnes)

Total Production for FY 2022-23- 127197 (000 tonnes)

The table provides data on steel production across different states for the fiscal years 2022 and 2023. In 2022, Odisha topped the chart with a steel output of 23.241 million tonnes, closely followed by Jharkhand, Chhattisgarh, and Karnataka. Maharashtra and Gujarat showed comparatively lower production rates.

However, in 2023, there was a noticeable increase in steel production across all states. Odisha's output surged to 23.398 million tonnes, Jharkhand to 18.164 million tonnes, Chhattisgarh to 15.876 million tonnes, and Karnataka to 13.393 million tonnes. Maharashtra and Gujarat also saw an uptick in production during this period.

These figures indicate a significant improvement in steel production from 2022 to 2023, suggesting advancements in the efficiency and capacity of the steel industry across the nation.

Demand and Supply Analysis of the Indian Steel Industry for FY 2022-23 and 2023-24

Understanding how demand and supply shape the steel industry in India for the financial years 2022-23 and 2023-24 reveals important insights into its performance and growth.

1. FY 2022-23:

Demand Analysis

● India's finished steel consumption in FY 2022-23 was 119.9 million tonnes.

● The steel demand was primarily driven by the construction and manufacturing sectors, with a significant increase in demand from these industries.

● The country's steel production increased by 7.4% in the year 2022-23 as compared to the previous year.

Supply Analysis:

● India's crude steel production reached 118.947 million tonnes in FY 2022-23, with finished steel production at 119.9 million tonnes.

● The steel industry faced challenges related to labor policies, licensing issues, and delays in clearances, impacting production capacity in both the public and private sectors

2. FY 2023-24:

Demand Analysis:

● The finished steel consumption in India estimatedly increased to 122.35 million tonnes in FY 2023-24.

● The steel industry witnessed a growth of 7.3% in production, reaching approximately 1,814.5 million tonnes in FY 2023-24.

● The steel demand increased as it was supported by government expenditure on infrastructure and manufacturing sectors in the long run.

Supply Analysis:

● The steel industry targeted a production capacity of 300 million tonnes by 2030, with a focus on increasing the production of high-grade steel products.

● Major players like Tata Steel and JSW enhanced their R&D capabilities to reduce import dependence and produce high-grade steel.

During FY 2022-23, India's demand for steel was strong due to increased needs in construction and manufacturing. Despite challenges, steel production rose by 8.8%. In FY 2023-24, steel consumption continued to grow, reaching an estimated 122.35 million tonnes. Supported by government spending, steel production increased by 7.3% to around 1,814.5 million tonnes. Looking ahead, the steel industry aims to expand its production capacity to 300 million tonnes by 2030, focusing on research and development to reduce import reliance and enhance high-grade steel production.

3. FY 2024-25:

Demand Analysis

- India's finished steel consumption is projected to grow by 8% annually, reaching approximately 132.5 million tonnes in FY 2024-25.

- Infrastructure and construction sectors remain the primary drivers of demand, with significant contributions from the automobile, defense, and manufacturing industries.

- Government initiatives like PM Gati Shakti and Affordable Housing under PMAY have further bolstered steel demand.

- Increased urbanization and industrialization continue to fuel consumption growth, aligning with India's economic development goals.

Supply Analysis

- Crude steel production is estimated to reach around 135–137 million tonnes in FY 2024-25, with finished steel production expected to surpass 132 million tonnes.

- India is progressing towards its target of 300 million tonnes of annual steel production capacity by 2030, with significant investments in plant modernization and expansion by key players such as Tata Steel, JSW Steel, and SAIL.

- The focus remains on enhancing the production of high-grade specialty steel to meet domestic and export demands, reducing import dependency.

- Technological advancements and sustainability practices are being adopted to improve energy efficiency and reduce carbon emissions in steel manufacturing.

Anticipated Steel Supply and Demand in India for FY 2024-25

The Indian steel industry is expected to continue its robust growth trajectory in FY 2024-25, driven by a combination of domestic demand, government initiatives, and global market dynamics. Here's an overview of the anticipated steel supply and demand in India during this period.

● Supply

India's crude steel production capacity is expected to grow at a CAGR of about 7.2% to reach 255 million tonnes by 2030-31. This growth is achievable given the industry's recent growth patterns, with crude steel production increasing by 7.6% in 2018-19. The government's National Steel Policy, 2017, envisions a growth trajectory for the Indian steel industry, with a focus on enabling market-led conditions to increase steel-making capacity and production.

● Demand

India's finished steel consumption is anticipated to reach 206 million tonnes by 2030-31, driven by a rise in per capita steel consumption to 160 kg. The construction sector is expected to lead the demand for steel in India, driven by government infrastructure spending and private investment. Additionally, the government's focus on the steel sector through the Production-Linked Incentive (PLI) scheme 2.0 is expected to further boost demand.

● Global Demand

Global steel demand is expected to grow by 2.3% in 2023 and 1.7% in 2024. The growth will primarily come from regions outside China, as China's steel demand is anticipated to remain flat.

The Indian steel industry faces challenges such as competition from cheaper imports, particularly from China, and the need to address raw material dependency and import pressures. However, there are also opportunities for growth, including the expansion of the secondary steel sector, the creation of steel capacity special economic zones, and the development of newer grades of steel for domestic and global markets.

The Indian steel industry is expected to continue its growth trajectory in FY 2024-25, driven by a combination of domestic demand, government initiatives, and global market dynamics. The industry faces challenges but also has opportunities for growth, particularly in the areas of capacity expansion and the development of new steel products.

The anticipated steel supply and demand projections for India's FY 2025-26 are based on data and insights from several authoritative sources:

- National Steel Policy (NSP) 2017: This policy outlines India's vision to enhance steel production capacity to 300 million tonnes by 2030-31, providing a framework for current and future growth projections.

Ministry of Steel - ICRA Report on Steel Industry: ICRA has revised its growth projections for domestic steel consumption, anticipating a 9-10% increase in FY 2025, reflecting robust demand in the sector.

- BusinessWorld Report on Steel Sector Growth: This report highlights the anticipated increase in India's steel production capacity by 20 million tonnes between FY 2025 and FY 2027, indicating significant supply expansion.

Source:

These sources collectively inform the projections for India's steel supply and demand in FY 2025-26, highlighting the industry's growth trajectory and the factors influencing it.

Steel Raw Materials: Production, Demand, and Price Trends

1. Steel Raw Materials in India

Steel raw materials are crucial elements that significantly influence production, demand, and pricing dynamics within the Indian steel industry. Let's delve into how these raw materials are performing based on the provided sources:

Production of Raw Materials:

Iron Ore: Iron ore stands as a cornerstone raw material for steel production in India. With mining operations spread across various regions, the country ensures a consistent supply of steelmaking. Companies like Tata Steel prioritize responsible mining practices to secure iron ore resources and maintain efficient production processes.

Coal: Coal holds equal importance as a raw material for steelmaking. Efficient and scientific coal mining operations provide steel producers with a competitive edge in production. The Indian steel industry relies on coal both for energy and as a reducing agent in the steelmaking process.

Demand for Raw Materials:

Iron Ore Demand: The demand for iron ore in India is propelled by the growth of the steel industry and infrastructure development projects requiring substantial steel usage. The industry's consistent demand for iron ore caters to construction projects, railways, roadways, and other infrastructure developments.

Coal Demand: Coal demand in the Indian steel industry closely correlates with steel production requirements. It serves as a vital source of energy and a reducing agent in the blast furnace process to convert iron ore into molten iron for steelmaking.

Price Trends of Raw Materials:

Iron Ore Prices: Iron ore prices directly impact the cost of steel production in India. Fluctuations in iron ore prices significantly influence the overall cost structure of steel producers, impacting their profitability and market competitiveness.

Coal Prices: Similarly, coal prices play a crucial role in determining the cost of steel production. Changes in coal prices directly impact the overall cost of steelmaking, subsequently affecting the final pricing of steel products in the market.

The performance of steel raw materials concerning production, demand, and price is pivotal for the Indian steel industry's operations. Iron ore and coal, as primary raw materials, are indispensable for steel production, and their availability, demand, and pricing directly influence the overall dynamics of the steel sector in India. Ensuring a steady supply of raw materials, managing demand fluctuations, and monitoring price trends are critical factors for the sustainable growth and competitiveness of the Indian steel industry.

2. Analyzing Raw Materials in India's Steel Industry

The steel raw materials in India's steel industry are doing well concerning production, demand, and price. Over the years, there's been significant growth in crude steel production, increasing from 101.45 MT in 2017 to 118.13 MT in 2021, showing a growth of 17.8% compared to 2020. This growth is thanks to the increasing infrastructure development and rising demand from sectors like automobiles, construction, consumer durables, and capital goods.

When it comes to demand, India's per capita consumption of steel has risen from 46 kgs in FY08 to around 75 kgs currently. This growth is fueled by the country's industrial and infrastructural development, which contributes to approximately 2.5% of the national GDP. During the fiscal year 2022-23, the Indian steel industry saw substantial expansion, as the production of crude steel went up by 4.2% to reach an all-time high of 125.3 million tonnes. In the following year, 2023-24, the steel demand remained strong, with an estimated growth of 7.5%, reaching 128.9 million tonnes. This surge was fueled by heightened demands from sectors like construction, railways, and capital goods, alongside promising economic growth predictions.

However, the price of steel raw materials has also seen an upward trend. For example, domestic flat HRC prices surged by 40% since April 2020, while long steel, or TMT, increased by approximately 30% during the same period. In April 2021, Indian producers announced further price hikes in HRC of up to 1,000-2,000 INR/MT.

Despite these positive trends, the Indian steel industry faces challenges such as high freight costs, which are 500% higher compared to Australia, leading to increased costs for steel producers. Additionally, the industry's specific energy consumption rates surpass the global average, adding to production expenses.

The Indian steel industry is witnessing strong demand and production growth, but it also encounters challenges like high freight costs and energy consumption rates. Despite these hurdles, the industry is expected to maintain its growth trajectory in the upcoming years, driven by the country's industrial and infrastructural development.

3. Raw Material Trends for the FY 2024-25

The Indian steel industry might see lower prices for its raw materials, like iron ore and coal, during 2024-25. Iron ore prices could go down, but they might not stay steady because of issues in China's property market and efforts by the Chinese government to boost their economy. A research agency called BMI thinks iron ore prices will average $120 per tonne in 2024.

Coal prices are also expected to drop in 2024 because there's too much coal available and not enough people buying it. The Australian Office of the Chief Economist predicts that global coal use will go down by 0.2% in 2024, but prices will still be higher than they were before the pandemic.

The Indian steel industry will probably need more non-coking coal in 2024-25, around 3% more than the year before. Most of this coal will be used in coal-fired power plants and the cement industry will also need about 46 million tons of non-coking coal during the fiscal year 2024-25.

So, overall, the Indian steel industry might benefit from lower raw material prices, especially for iron ore and coal, during 2024-25. This could mean lower costs for making steel and possibly cheaper prices for steel products.

Analysis of Commodity Prices with a Focus on Steel

Over time, the growth of the world economy, industry demand, and raw material prices have influenced the steel price trend. Steel prices often rise in periods of economic boom. This is the effect of more demand from the manufacturing industries. They tend to decline in periods of economic contraction because of lower demand.

The global steel industry in India also shows similar trends in other regions. The international commodities markets significantly impact the price of steel in India. The reasons are global supply and demand imbalances, changes in raw material costs, and shifts in the state of the world economy. For example, if major manufacturing nations restrict supply the demand increases globally. Hence, steel prices in India may rise.

Forecasting Models and Future Price Predictions in the Steel Market

● Steel price forecasting models often incorporate variables. These are macroeconomic indicators, and the cost of raw materials. These models aim to identify patterns in future price fluctuations. They do so to help stakeholders make informed decisions.

● Steel prices are prone to brief variations brought on by changes in global demand.

● Long-term price stability requires many variables. It leads to advancements in the technology of steel production. It shifts towards more sustainable industrial practices, and trends in economic growth.

Conclusion

The steel industry in India is experiencing unprecedented growth and excitement. However, there is significant potential for expansion. We need to pay attention to a lot of challenges. Following rules by the government and safeguarding the environment are some of them. Due to modern technologies, the steel industry has boosted productivity.

Governments may have a major role in the steel industry's prosperity. They support eco-friendly practices and pass pro-business legislation. This implies that there are less environmentally hazardous ways to produce steel. India's steel industry has a lot of room to expand. The country is still developing and needs a lot of steel for its building projects.

Furthermore, other countries need India's superior steel. PriceVision helps professionals in the steel sector to make better-informed judgments. They can gain valuable and informative insights into the market.