Cotton Prices are Under Pressure Because of Large Indian Stocks

September of this year saw a decline in cotton prices. because of weak physical market demand and enhanced chances for output. Nevertheless, their prices have barely recovered, mainly due to increased anxiety over crop losses. With recent unusual rainfall in the north of India, In Punjab, prices saw fewer arrivals in October, which also helped prices increase from their previous lows.

So far, cotton prices have moved in line with their seasonality between October and December. Cotton prices typically remain high throughout. thanks to an increase in exports, the winter season demand from nearby countries and the local demand on the market throughout the winter season, which usually gets better between October and December. However, this year's price growth will be limited partly because of demand concerns.

The Market Drivers

- Increased production supplies

- Unsatisfactory demand

Indian production of cotton will rise by 9%. Y-O-Y

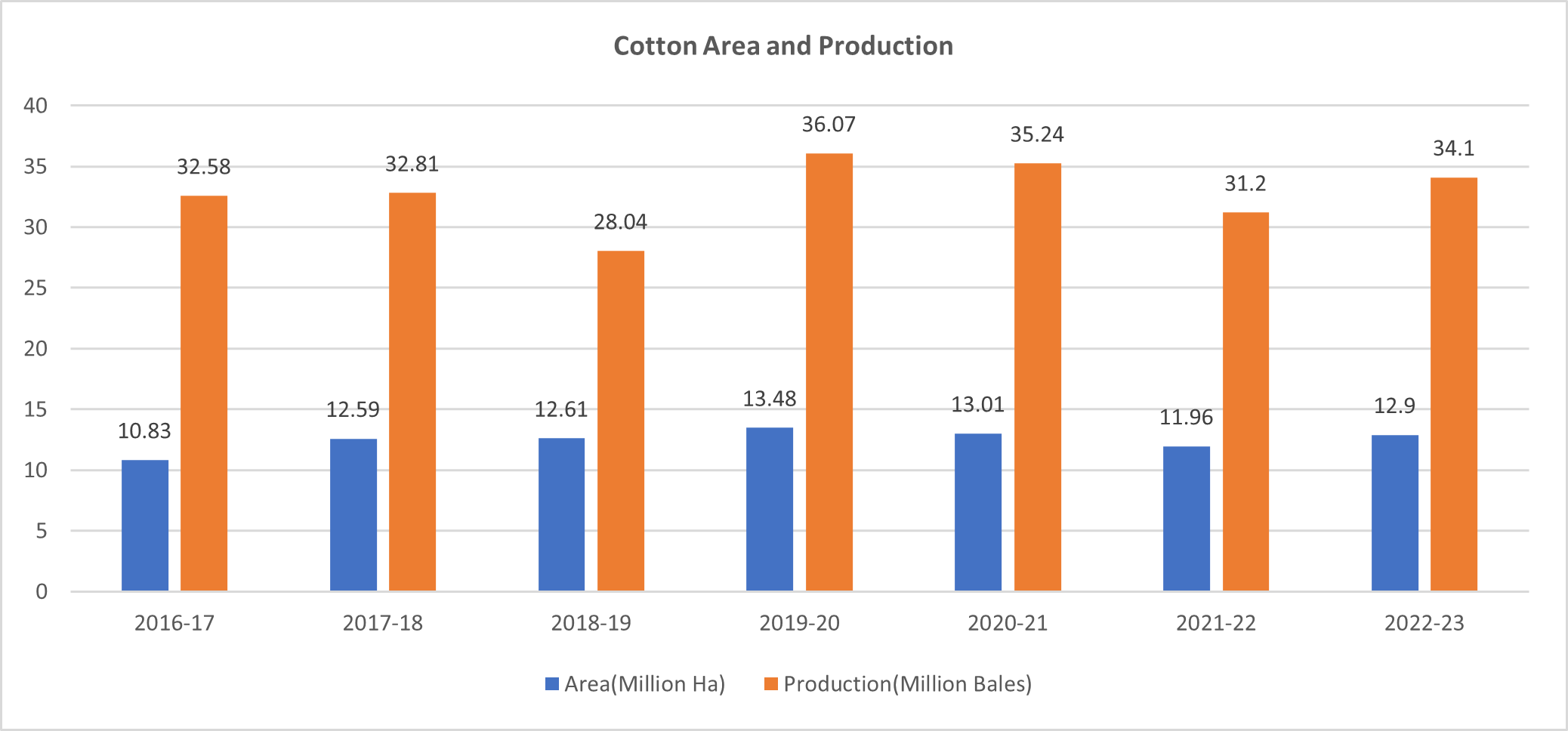

This year's cotton production is anticipated to be strong due to an increase in crop area. In India, 360 lakh bales of cotton are anticipated to be produced in 2022–2023, an increase of 15% over the previous year. In a similar vein, the Ministry of Agriculture forecasts an increase in cotton production to 341 lakh bales in 2022 from 312 lakh bales in previous years. Indian cotton yields are expected to rise considerably because of above-average precipitation in the main cotton-growing regions.

Unsatisfactory Demand

Fundamentals of demand are also not promising for pricing, as millers choose to buy on a hand-to-mouth basis in expectation of a bumper crop. Millers refrain from making aggressive purchases due to the increased moisture content in the fresh crop. As the world economy slowed, recession fears increased and the market for textiles decreased, cotton yarn demand stayed lower. Forecasts for demand were also impacted by increased imports of cotton yarn into India because millers preferred imported cotton yarn over local cotton yarn due to higher domestic prices. The United States prohibition on the import of Chinese yarn is hurting demand for Indian cotton exports because Chinese millers have scaled back their purchases from India.

Prices are expected to fall because of the supply being sufficient in the short term due to the decline in export hopes and the positive production outlook.

According to the Index of Industrial Production (IIP)-Quick Estimates of IIP August 2022, the textile industry's output volume decreased by 12% in August 2022 compared to the same month the year prior. When compared to the same period in 2018, textile production has declined by 4% year over year (April–August 2022). The margins for items made from cotton are being eroded by increased input prices (fibre, fuel, and labour), according to IIP estimates.

Outlook for Cotton Prices

Due to concerns about demand, cotton prices are anticipated to decline shortly. Millers are using hand-to-mouth purchasing due to the restricted supply of high-quality products in the market and the higher moisture content of recent arrivals that reached the market in October.

Additionally, cotton's dim export prospects to China and the accessibility of cotton yarn in India may put pressure on pricing shortly. As a result of drier weather conditions in India's central and northern regions, which would help harvesting activities, the number of arrivals is projected to increase. However, as demand is anticipated to pick up after Diwali, prices may find support in the final week of October. The seasonal trend of exports indicates that between 30 and 40 per cent of India's total cotton exports are accomplished from October to December. expected increase in export demand from Bangladesh and other SEA countries. Nations will aid in price recovery in the future. for a portion of Oct. A declining Indian rupee will encourage increased exports of raw cotton and textile possibilities, but only allow extra-long imports of cotton staples.

Factors Affecting Cotton Prices

- The inter-crop price parity, domestic demand-supply situation, cost of production, and global pricing environment are the main influences on market prices.

- Government rules on import, export, and minimum support prices are key influences on cotton pricing.

- Weather, pests, diseases, and other risk factors linked to agricultural products also have an impact on cotton production.

- Global trade is crucial for cotton, as seen by the remarkable link between cotton yarn prices across the nation and the price of raw cotton in India (over 90%).

- In addition to being traded directly as yarn, fabric, and clothing, cotton makes up around 30% of the world's textile production.

Market Prospects

Cotton predictions for both the short and long-term forecast.

Short-term

- The Russia-Ukraine war is likely to harm cotton prices as a reduction in consumer spending and mill demand is anticipated to exacerbate the negative effects of current demand restraints like high inflation, rising interest rates, and the withdrawal of stimulus packages.

- In addition, rising ocean freight costs due to rising crude oil prices and current container shortages are anticipated to discourage new orders for cotton exports. In addition, a stronger U.S. dollar might further reduce cotton demand, which would drive down prices. Given the uncertainty in demand across the world, mills are likely to exercise caution and hold off on placing orders for cotton, which could result in higher stock levels.

Long-Term

- The Russia-Ukraine crisis has caused commodity prices to soar, including those for wheat, corn, and sunflower. As a result, spring sowings of cotton are likely to be replaced by other crops with higher returns. Initial estimates point to an increase of 4.4 per cent in the world's cotton harvest area for 2022–2023; however, this increase is likely to come with risks.

- In addition, more clarity on global demand will decide price levels in the medium term. According to preliminary projections, prices will rise by 1.7% Y-o-Y in 2022–2023. Long-term price stability is likely to be maintained by growing input costs like fertiliser and energy, while rising crude oil prices are projected to drive up the cost of alternative polyester fibre, driving increased demand for cotton globally.

There is increasing demand for cotton from sustainable sources.

The supply of sustainable cotton is expected to rise as a result of the upward trend in compliance and accreditation to sustainable standards, and a continuous gain in market share for sustainable sources of natural fibre relative to conventional sources is envisaged.

The increased sustainability commitments of big brands and retailers, along with rising consumer awareness of environmental responsibility, are likely to trigger a boom in demand in the upcoming years. In the short term, this is expected to reduce general supply and maintain prices, which are already at substantial premiums over conventional sources.

There are many sustainable cotton standards on the market, but the Better Cotton Initiative (BCI) has the largest market share and includes the BCI standard as well as BCI equivalents like the ABRAPA (Brazilian standard), Cotton Made in Africa, and MyBMP (Australian standard). Together, these standards will account for about 24 per cent of the world's total cotton production in 2020, making them the most popular sustainable cotton source.

The other two main sustainable cotton sources are recycled cotton and organic cotton. While it is anticipated that the supply of organic cotton will be more constrained in 2021 due to lower production in India, a major producer, because of unpredictable rainfall and insect infestations, the market supply is anticipated to rebound in 2022. Conversely, recycled cotton, on the other hand, is expected to keep expanding in output thanks to downstream sectors' growing environmental responsibilities. To get interesting insights, follow https://pricevision.ai/blog/

Viewpoint

With the premium of Indian cotton prices to global cotton prices falling from 40% in June 2022 to 7% in September 2022, the gap between domestic and international cotton prices has considerably shrunk. The introduction of new season cotton and the probability of an 11% increase in production in CS 2022–23 could cause additional softening in cotton prices. The tide for the Indian cotton textile value chain may shift in its favour if such a situation lasts for a longer period with higher global cotton prices. India's global competitiveness in the global cotton textile trade is estimated to increase as a result of the anticipated drop in cotton prices. Although there may be short-term difficulties (a slowdown in important export markets), we think there is room for sustainable long-term growth. In order to know the accurate commodity forecasting visit PriceVision.