Commodity Price Forecasting: Artificial Intelligence (AI) - Machine learning (ML) Techniques

The fluctuations in commodity prices can significantly affect the global economies and living standards in many countries. Under geopolitical tensions, an accurate AI/ML forecast solution has never been more important for business leaders and industrial authorities to make better decisions. Commodities play a crucial role in the global economy, wherein 5% of the market is composed of just the oil industry and natural gas industry.

Other significant contributors include other energy, metal, mineral, and agricultural commodities. Hence, commodity prices are one of the major motivators of inflation and economic activity. When talking at an individual level, this affects the cost of living of various households around the globe, directly via petrol prices and indirectly through other consumer goods prices. This article will review the commodity market and its relationship to the global economy and explain how managers can leverage data to improve forecasting methods using AI-ML solutions.

Commodity Price Forecasting Using Machine learning

Commodity price forecasting refers to the process of making forecasts of the future price of agricultural or mining products based on previous and present data or trends analysis. The forecasts will consider risk and uncertainty elements. Daily commodities are essentials that account for a sizable portion of the product market.

The variation of commodity prices is an obvious phenomenon that has a significant impact on the cost of living. An early valuation can aid in price control by analysing and changing market prices in advance so that the commodity market functions smoothly. This is where advanced AI/ML Based Commodity Price Forecasting solutions from Thoucentric labs with self-learning capability shine as a powerful tool to manage complex price forecasting tasks.

What is a Commodity?

A commodity is a product that may be processed and resold, such as an agricultural or mining product. Palm, wheat, crude oil, gold, and silver are examples of such items.

Every day, a large number of goods are bought and sold all over the world. Producers and miners must sell their products, while manufacturers must purchase raw materials.

How Commodities Work

Commodities are exchanged in a futures market, where producers and buyers haggle for payment. These contracts also specify a future date for the delivery of the items. Commodity traders can be:

· Investors and speculators

· Businesses that acquire or use goods

· Consumers and strategic users

· Farmers and miners who generate things.

This can be done on the spot market, where commodities are bought and sold “on the spot” However, commodities trading is much more complex than simply buying and selling goods on the spot market. Most commodities trading is done on the futures market as futures contracts. Commodity future trading platforms are MCX, NCDEX, CBOT, BMD etc.

Factors affecting the commodity Price volatility

Demand and supply play a prominent role. Natural gas, electricity, and oil prices are often more volatile than prices for other commodities. One explanation for the volatility of energy costs is that many users have limited options for substituting alternative fuels when the price of natural gas, for example, varies. Residential customers can typically not change their heating systems rapidly, and it may not be cost-effective in the long term.

As a result, whereas customers may easily replace food goods when relative prices of foodstuffs vary, they do not have that option when it comes to heating their houses. Over the long term, other key factors vary from income, global intense production competition, innovative technologies, central policies, and economic growth. In the short term, commodity prices are influenced by weather events, interest rates, biofuel mandates or speculation.

How to Forecast Commodity Price with Price vision AI-ML

The main highlight of our product is the ML-based price prediction for commodities for different time horizons across major Futures Market Exchanges & Spot markets. Buyers & Procurement managers are every day struggling with making some near-accurate forecasts for Commodities which are Raw materials or Feedstock for Finished products.

Risk managers are finding it difficult to manage price risk & make Hedging decisions. In today’s scenario, all this is done based on the gut feel & rudimentary indicators. To eliminate human emotions & gut feelings in price forecasting, we developed a Tool namely PriceVision for Commodities price forecast which is AI / ML driven.

Commodities Available

A) Agri

i) Palm oil (BMD Spot Kandla)

ii) Soybean, Soymeal Soyoil, Sunflower oil

iii) Corn Oil,

iv) Sugar, Coffee, Wheat, Cocoa, and Cotton – upcoming

B) Energy

i) Crude oil Brent

ii) Crude oil WTI

iii) Ethanol and Coal – upcoming

C) Metals

i) Copper

ii) Aluminium

iii) Gold

iv) Silver

v) HRC

D) Chemicals

i) Acetic acid

ii) PP (Polyether polyols) - upcoming

iii) TDI (Titanium dioxide) - upcoming

E) Chemicals

i) PP (Polyether polyols) - upcoming

ii) TDI (Titanium dioxide) - upcoming

F) Forex (INR/USD/BRL/Euro) - upcoming

What PriceVision Offers

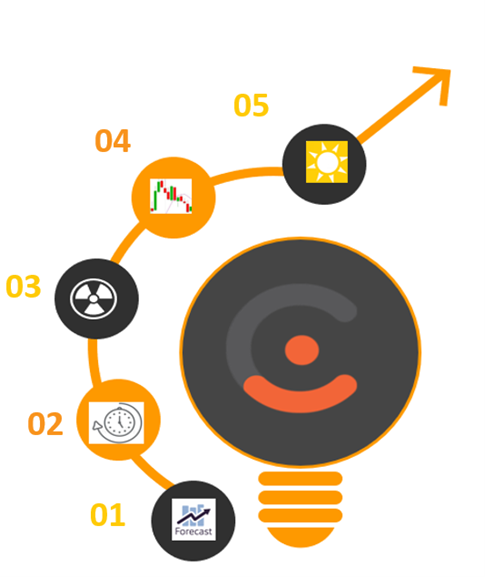

1. Price Forecast:

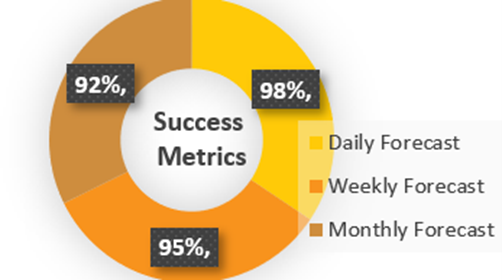

This feature will help the user to have a view of the Price forecast of a commodity for Daily, Weekly & Monthly granularity. Price forecast will be derived using AI/ML models. Price Forecast can be for “X” days ahead or “Y” Weeks forward Or “Z” Months in advance.

2. Historical Price Trends:

Highlights the historical actual price trend of the commodity at various intervals. There will also be a drop-down to plot some key drivers along with the trend.

3. Drivers:

Variables affecting the Prices of commodities are highlighted here. The top few will be shown as a word cloud for users to understand the impact of each driver in varied sizes.

4. Volatility:

Volatility is a price variation of a commodity for a specific interval. This plays an important role in the price trend of commodities for specific intervals which is what we want to highlight in the Tool.

5. Seasonality:

Explains the price trend of a commodity for specific years & plots them together to give a view of the cyclical & seasonality trend of the commodities.